To do so, they’ll often use banded momentum indicators such as the stochastic oscillator and RSI to identify overbought and oversold conditions. Range traders use support and resistance levels to determine when to enter and exit trades and what positions to take. Range traders are less interested in anticipating breakouts (which typically occur in trending markets) and more interested in markets that oscillate between support and resistance levels without trending in one direction for an extended period. Finally, if price breaks through this established range, it may be a sign that a new trend is about to take shape. Similarly, when price approaches the oversold (support) level, it’s considered a buy signal. When price reaches the overbought (resistance) level, traders anticipate a reversal in the opposite direction and sell. In a ranging market, however, price moves in a sideways pattern and remains bracketed between established support and resistance thresholds. In a trending market, price will continue to break previous resistance levels (forming higher highs in an uptrend, or lower lows in a downtrend), creating a stair-like support and resistance pattern. Together, these support and resistance levels create a bracketed trading range. On a price action graph, support and resistance levels can be identified as the highest and lowest point that price reaches before reversing in the opposite direction. Range trading is based on the concept of support and resistance. Although you may not be the first one to enter the trade, being patient will ultimately shield you from unnecessary risk. To trade effectively, however, it’s important to confirm the direction and strength of a new trend before entering into a position.

As such, it tends to be a more reliable and consistent strategy. Trend trading doesn’t require traders to know what will happen next-only to understand what is happening right now. These indicators help traders identify when price is approaching overbought or oversold levels and provide insight into when a change will occur. Price momentum will often change before a price change occurs, so momentum indicators, such as the stochastic oscillator and relative strength index (RSI), can also be used to help identify exit points.

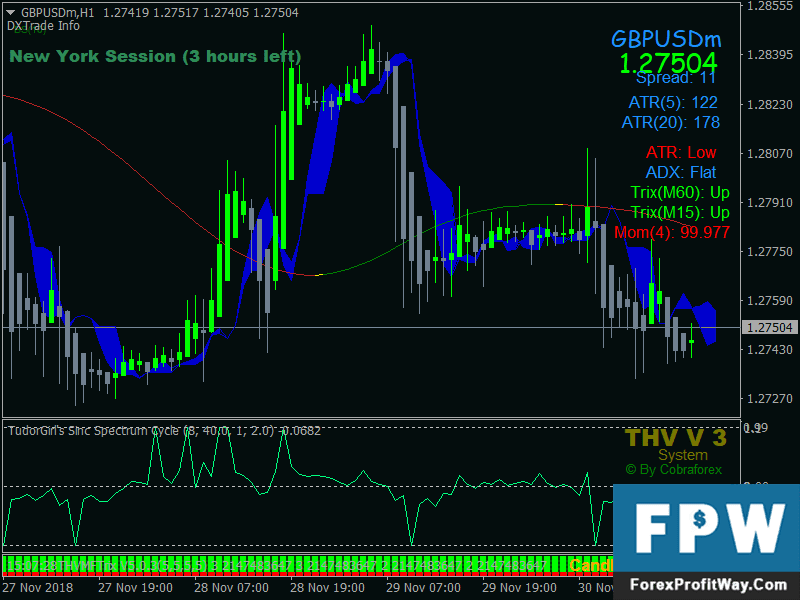

Once the new trend has manifested, the trader will once again trade in the direction of the current trend. Rather than anticipating the direction of the reversal and entering into a new position, trend traders will use these signals to exit their current position. When price fails to reach anticipated support and resistance levels, or when a long-term moving average crosses over a short-term moving average, it’s thought to signal a reversal. In addition to providing insight into the current trend direction and strength, moving averages can also be used to gauge support and resistance levels. All moving averages are lagging indicators that use past price movement to lend context to current market conditions. To determine the direction and strength of the current trend, traders often rely on simple moving averages and exponential moving averages such as the moving average convergence/divergence (MACD) and average directional index (ADX). For obvious reasons, trend traders favor trending markets or those that swing between overbought and oversold thresholds with relative predictability.

When investing in the direction of a strong trend, a trader should be prepared to withstand small losses with the knowledge that their profits will ultimately surpass losses as long as the overarching trend is sustained. For this reason, trend trading favors a long-term approach known as position trading. In a trend trading strategy, the trader doesn’t need to know the exact direction or timing of the reversal they simply need to know when to exit their current position to lock in profits and limit losses.Įven when a market is trending, there are bound to be small price fluctuations that go against the prevailing trend direction. All of these factors will tell them how strong the current trend is and when the market may be primed for reversal. In order to do so effectively, traders must first identify the overarching trend direction, duration, and strength. As the name suggests, this type of strategy involves trading in the direction of the current price trend. Trend trading is one of the most reliable and simple forex trading strategies.

0 kommentar(er)

0 kommentar(er)